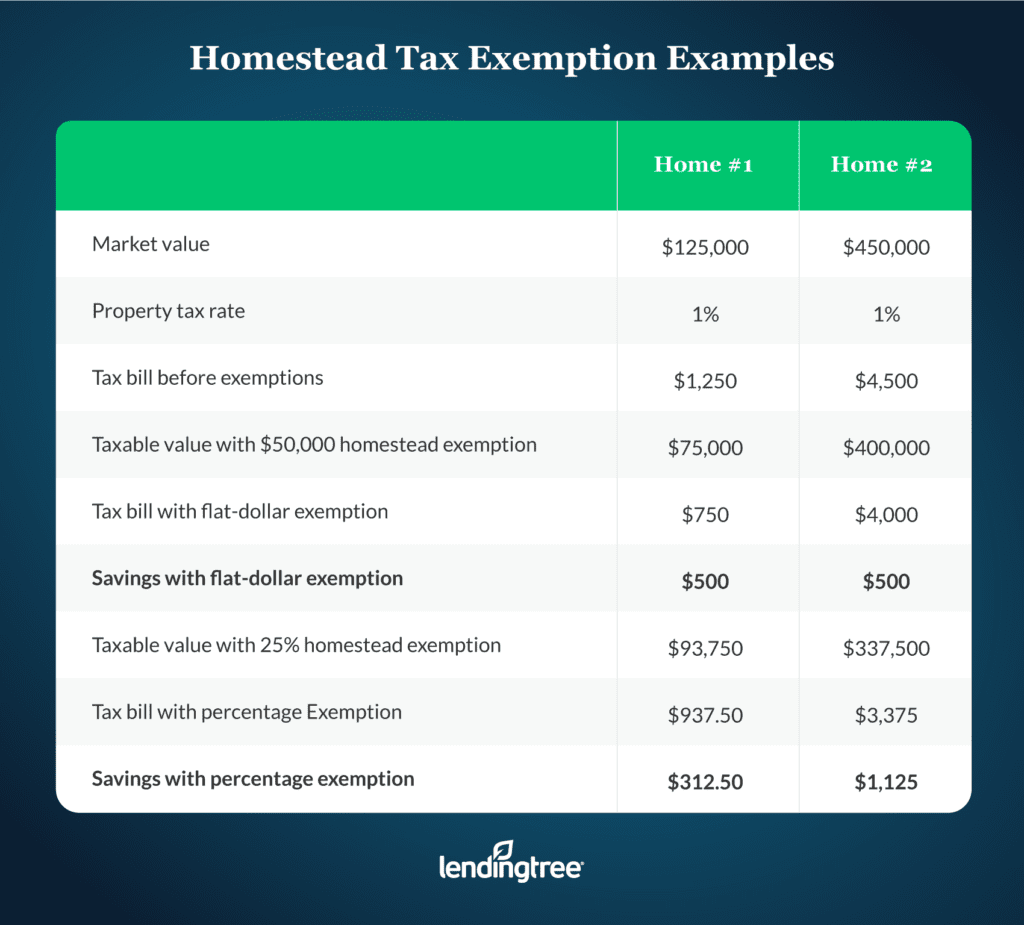

California Homestead Exemption 2025 Calculator. Most states offer a homestead exemption, except for new jersey and pennsylvania. The recent legislation, assembly bill 1885, significantly increased the california homestead exemption amounts.

This reduces the assessed value by $7,000, saving you at least $70 per year. Homestead equity of $300,000 or;

California Homestead Exemption 2025 Calculator Dody Nadine, While the rules for homestead exemptions vary by state, here in california, we recently had an increase in the.

California Homestead Exemption 2025 Calculator Dody Nadine, This reduces the assessed value by $7,000, saving you at least $70 per year.

California Homestead Exemption 2025 Calculator Dody Nadine, (a) the amount of the homestead exemption is the greater of the following:

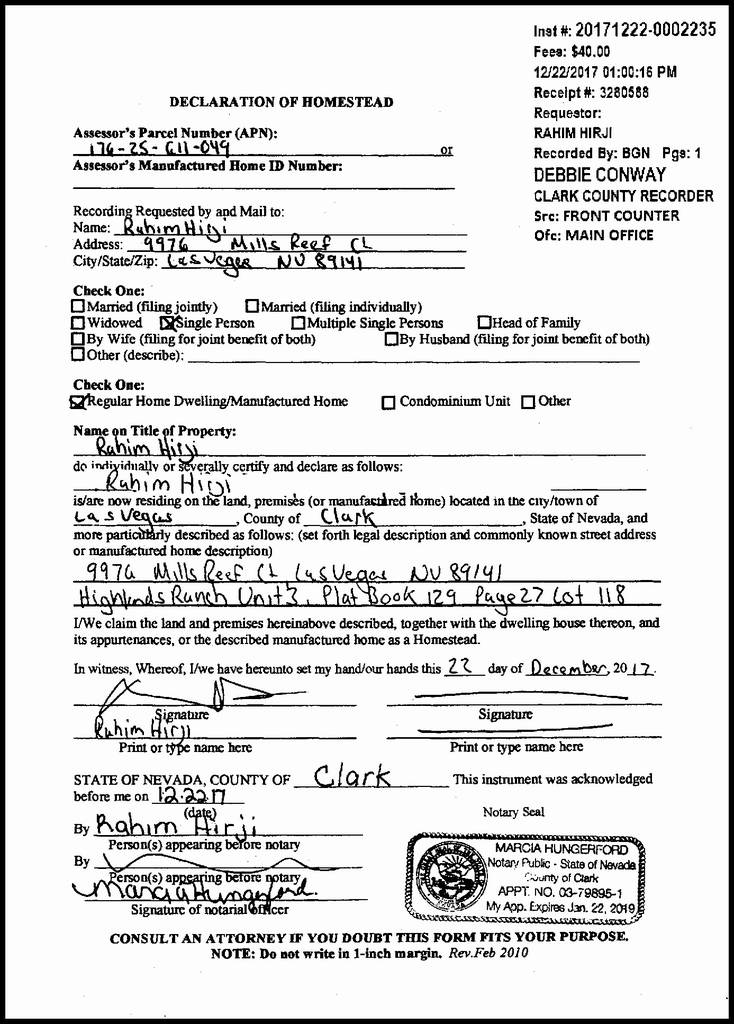

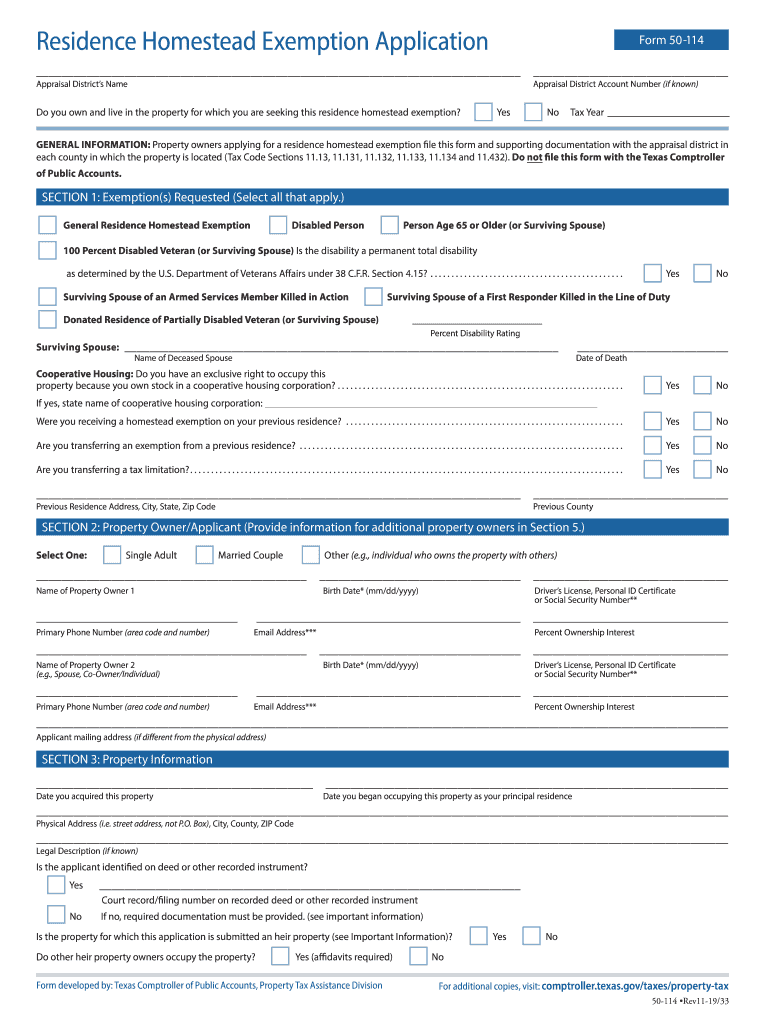

Homestead exemption Fill out & sign online DocHub, The homeowners' exemption allows an owner to reduce property tax liability on a dwelling which is occupied as the owner's principal place of residence as of 12:01 a.m.

California Homestead Exemption 2025 Calculator Dody Nadine, Before ab 1885 went into effect on january 1, 2025, the homestead exemptions in california were.

California Homestead Exemption Form Riverside County, Homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on their primary residence.

Homestead Exemptions by State in USA in 2025 Bezit.co, That’s even more generous than the originally enacted $600,000.